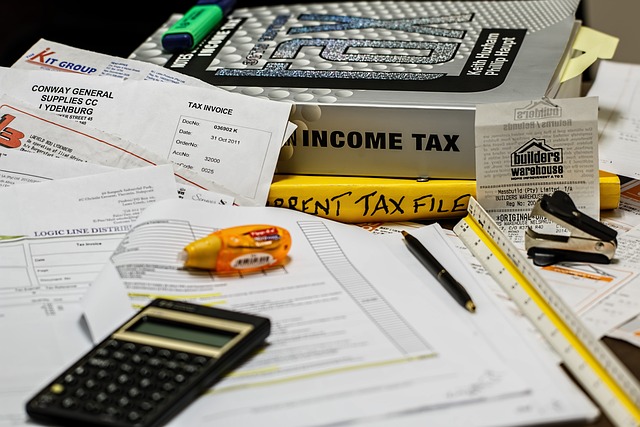

After the holidays, thoughts turn to…taxes! To help you determine the documents you need to gather we’ve put together a summary of which documents you’ll need to prepare your return. Your specific situation may require additional information.

These are some of the documents that are needed to prepare your return:

- W-2s if you worked at a job for wages

- 1099-Int if you received interest this year

- 1099-Div if you had dividend income

- 1099-B if you sold any stocks this year

- 1099-SSA if you have Social Security income

- K-1s if you are a partner in a partnership, own an s-corporation, or are the beneficiary of a trust

- Business income and expenses

- Contributions to 529 plans

- Deduction documentation such as:

- Unreimbursed medical expenses

- Property taxes paid

- Mortgage interest statement

- Charitable contributions

When in doubt, save it and share it with your tax preparer.

Ideally, you have a separate folder for each tax year on your computer or a cloud-based backup. Physical copies of your documents will work as well, but having digital copies is helpful for gathering documents quickly in the event of an audit or inquiry from the IRS. Staying organized is crucial to ensure you don’t miss any important paperwork!

Buffalo First offers comprehensive tax preparation services. If you would like us to handle your return, Please contact us at 716-445-7465 or email info@buffalofirstllc.com.