Financially Fit Retirement Series

Allen Dembski and Taunya Abaya continue their series on retirement. In the latest episode they discuss retirement and the cost of healthcare during retirement. We have a great deal of financial information online on our YouTube Channel. Please browse the various videos for a wide range of topics.

September is Life Insurance Awareness Month

On this week’s Financially Fit Allen Dembski, Managing Partner, and Taunya Abaya, Financial Advisor and CFP®, discuss the importance of life insurance. There are three different types of life insurance that are briefly discussed. If you want to have a more in depth conversation about life insurance, don’t delay, please reach out. We are available […]

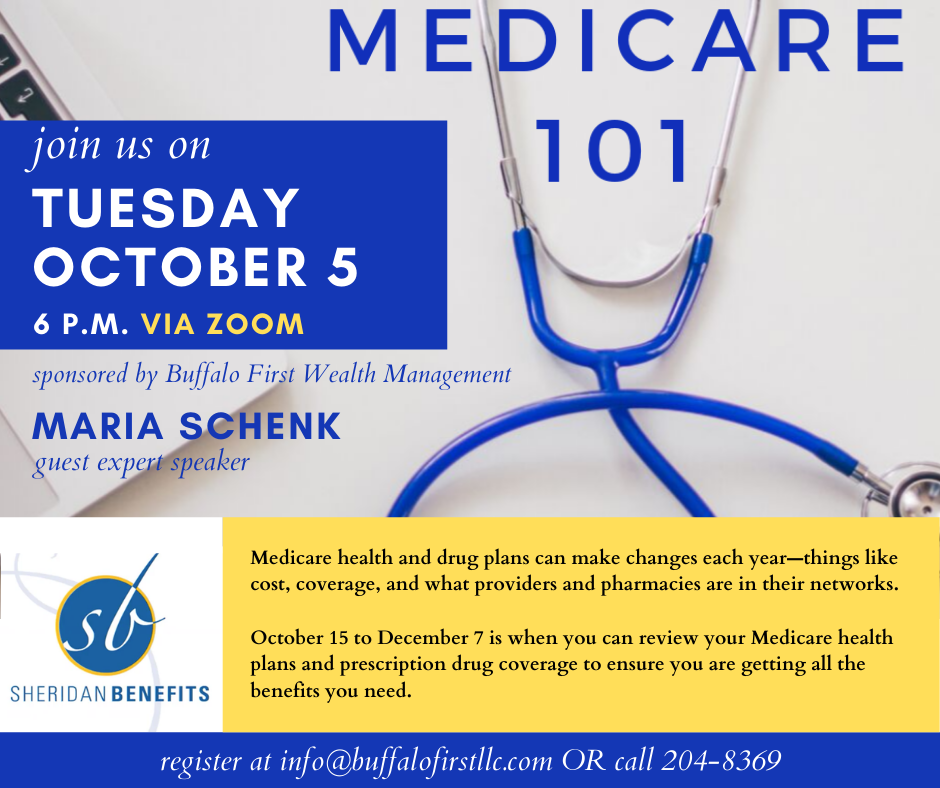

Medicare 101 Seminar

Medicare is a federal program that provides health insurance to retired individuals, regardless of their medical condition, and certain younger people with disabilities or end-stage renal disease. Medicare coverage consists of two main parts: Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). These parts together are known as Original Medicare. A third […]

403(b) Plans

On our most recent “Financially Fit” Allen Dembski and Taunya Abaya discuss 403(b) plans for teachers. If you are a teacher please pay close attention to the fees your plans are charging you. Of course all investment options charge some type of fee, but there are alternatives to the high fees some of these plans […]

Life Insurance Options

This week on “Financially Fit” we feature two client case studies to discuss various life insurance options. Make sure your family is protected, please reach out to us with any questions about your insurance needs.

Financially Fit: Stock market trading frenzy

On our most recent “Financially Fit” Allen Dembski and Taunya Abaya discuss the recent stock market trading frenzy with GameStop, AMC and other stocks. We discuss short sales, naked calls and covered calls. Please see our video on our youTube Channel for the entire discussion.

New Satellite Office

We are pleased to announce the opening of our new office at 341 Delaware Ave., Tonawanda, NY 14127. We are able to help clients with Tax Preparation and Planning in addition to all aspects of Financial Planning, Retirement Planning and Investing and either of our offices.

Year-End Tax Planning

In case you missed it, we had another online seminar last week. Michael Knapp, one of our Financial Advisors as well as a trained Accountant, discussed Year-End Tax Planning. There are steps you can still take to help minimize your tax burden. Allen Dembski, our COO, also discussed the SECURE and CARES Acts. Watch the […]