Financial Planning with Buffalo First Wealth Management, LLC

No one can predict the future, but that doesn’t mean you shouldn’t plan for it. At Buffalo First, our financial advisors can help you develop strategies to bring your retirement goals within reach.

We understand that retirement is more than just about money. It’s about living a comfortable, worry-free life and making sure you’re as vital, engaged, and excited in your retirement years as you were in your working life.

To support this vision, we offer insights that prepare you for every financial turn. Whether it’s navigating the complexities of tariff-related volatility or understanding the nuances of dollar-cost averaging, our guidance is designed to empower you.

Key Considerations:

- Tax Strategies: Learn how taxes should factor into your investment decisions, ensuring that your financial plans are as efficient as possible.

- Market Volatility: Equip yourself with the right questions to ask an advisor when markets get volatile, helping you make informed decisions with confidence.

- Retirement Planning: Understand how to plan for your income needs across the three stages of retirement, ensuring a stable and fulfilling future.

Incorporating these comprehensive strategies alongside our personalized approach ensures that you not only achieve financial security but also thrive in your golden years.

That’s why we take a comprehensive approach to retirement planning. We’ll work with you to assess your financial situation, develop a retirement budget, and identify the best strategies to help you reach your goals.

We also offer a variety of services to help you manage your retirement savings, including:

- Investment management

- Retirement planning

- Estate planning

- Tax planning

We’re here to help you make the most of your retirement years. Contact us today to learn more about how we can help you achieve your retirement goals.

Here are some of the benefits of working with Buffalo First Wealth Management, LLC:

- We have a team of experienced financial advisors who can help you develop a customized retirement plan.

- We offer a variety of services to help you manage your retirement savings, including investment management, retirement planning, estate planning, and tax planning.

- We are committed to helping you achieve your retirement goals.

How Do Our Financial Advisors Bring Fresh Perspectives to Financial Planning?

Navigating the complexities of personal finance can be daunting, but our seasoned financial advisor can illuminate fresh paths for your financial future. Our unique approach integrates various elements of your financial life, ensuring that your current decisions align with your long-term aspirations.

Tailored Insights and Strategies

We employ a customized strategy to each client’s unique situation. By thoroughly understanding your goals, whether they involve retirement, education, or wealth growth, advisors craft personalized plans that effectively bridge the gap between your present status and future aims. We leverage industry insights and employ diversified investment approaches to foster your financial advancement.

A Comprehensive View of Wealth

More than just number-crunchers, our professionals help connect all aspects of your finances. By analyzing your current lifestyle, income, debts, and market trends, they offer a holistic view of your wealth. This panoramic perspective enables you to make informed, coherent financial choices, aligning daily financial decisions with broader life goals.

Access to Expertise and Resources

We have at our disposal a rich pool of resources. By tapping into this wealth of information, our advisors offer insights into complex investment avenues, continuously updating your portfolio to reflect the latest market developments. This adaptability ensures that your financial plans are not just reactive but proactive in seizing new opportunities.

Mental Peace and Proactive Planning

Entrusting your financial planning to us brings peace of mind, knowing that we are focused on your financial well-being. We prepare you not only for current economic conditions but also for unforeseen changes, facilitating a future where you can pursue your goals with confidence and clarity.

By taking advantage of the expertise and fresh perspectives we provide, you can navigate your financial journey with more clarity, confidence, and strategies tailored to your unique needs.

Contact us today to learn more about how we can help you plan for a successful retirement.

Are You Ready For Retirement?

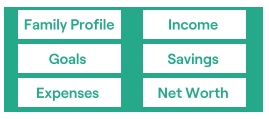

See Your Financial Goals

On track for retirement? Buying a house? Saving for college?

Track Expenses

Stay on top of your budget and track your expenses.

All Accounts in One Place

Link your financial accounts with automatic daily updates.

Unlock More Value!

Retirement, college planning, Social Security optimization, tax planning, and more

3 Easy Steps to Get Started

Create a free account.

Use guided process to enter your info.

Track net worth, spending, and all accounts in one place.

3 easy steps

Free Customized Retirement Report

Take our quick assessment to get your FREE customized retirement report in 4 easy steps.