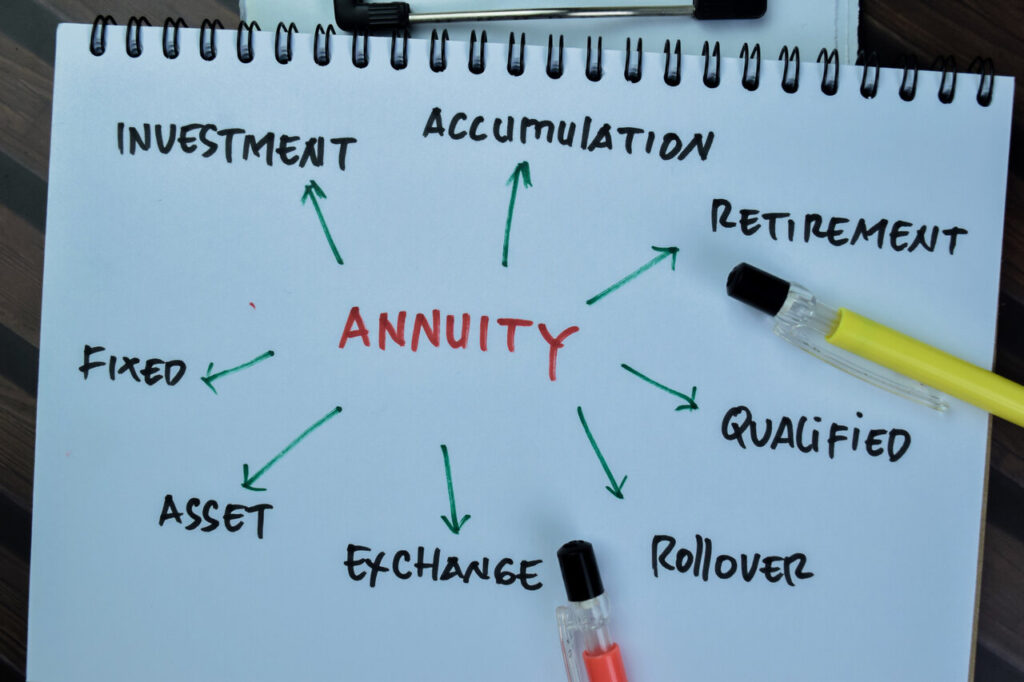

An annuity is a contract with a company that provides a specified sum of money for a specified period of time, based on a number of variables. One thing everyone can agree on regarding annuities is that there are many, many different types of annuities. In addition, annuities can include many types of options or “riders” that can confuse people.

Annuities may have a role in an individual’s retirement plan, but often get a bad rap. This is generally because of the cost of the annuity plus the rider fees can run over 3%. For years, annuities were sold by insurance individuals as an all or nothing solution tying up all of an investor’s savings into the annuity, leaving little funds for other purposes. This has resulted in some investment pundits proclaiming that annuities are evil and should never be used!

However, annuities can really benefit the right individuals in the right situation. We have seen situations where if a person didn’t have the second guaranteed income source from an annuity, their financial well-being in retirement would have been more challenging, and they likely would have run out of money in later life. This is not an easy conversation to have with a client.

There are 2 main income options when it comes to receiving income from an annuity. The first option is called annuitization. When a client annuitizes their contract the insurance company takes the contract value and looks at the mortality table to determine the income amount that is guaranteed for that client’s lifetime. Once you decide you want this option, you are essentially giving your money to the insurance company in return for that lifetime income. Don’t worry, there may be options to pass the funds onto someone else if you pass away. You will need to work with the company providing the annuity to identify those options.

The other option is to purchase a rider specifically designed for lifetime income. When you purchase one of these riders and collect the income you are not surrendering the funds to the insurance company. In many circumstances you can cash in the contract for the remaining funds minus surrender charges.

In some cases the cost of purchasing an annuity is worth it. Always list out the pros and cons to each solution and choose what is best for you and your family. It is also a good idea to seek a second opinion to determine if the annuity is the best investment for your needs. With all the options available, it is definitely not a one size fits all answer.